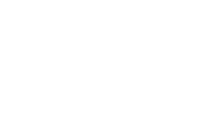

Children 6 Months to 5 Years

Early Learning Center

High quality learning environment for children with & without disabilities.

Infants to Pre-Teens

Therapy Services

Our therapy clinic has programs for children with cerebral palsy and other disabilities.

For Children and Adults

Home & Community Services

Provides attendant care, habilitation, & respite in the member’s home or community.

Treatment and Training

Day Treatments for Adults

Services for adults with disabilities in a center based setting and/or community.

POSSIBILITIES REALIZED ™

United Cerebral Palsy- Comprehensive Disability Services and Beyond

United Cerebral Palsy of Central Arizona (UCP) goes beyond cerebral palsy, supporting individuals with various disabilities. Our expert team specializes in ``Whole-Life Care`` from early detection, early learning centers, and pediatric therapy, to adult day treatment, and home and community-based services. Our vision remains unchanged: empowering individuals to reach their full potential and enhance their quality of life. Join us at UCP of Central Arizona.

Our 41 Year Partnership With Circle K

FUELING HOPE FOR ARIZONA FAMILIES

Look for our donation box at Circle K stores in Arizona.

Thank you to our generous corporate partners

Our Partners and Sponsors

POSSIBILITIES REALIZED ™

SHARING STORIES FROM THE UCP OF CENTRAL ARIZONA COMMUNITY

Norah Shares Journey and Book on Fox 10

Little girl with cerebral palsy helps others learn about acceptance through her book. PHOENIX – A children’s book about a local little girl with cerebral palsy is helping teach others about acceptance. Norah Allgaier is just five years old, but her

UCP of Central AZ Ambassador Norah Shares Book on AZ Family

New children’s book about cerebral palsy inspired by Cave Creek girl PHOENIX (3TV/CBS 5) — March is National Cerebral Palsy Month. It’s a motor disorder that affects body movement and muscle coordination and it’s the most common motor disorder among k

UCP of Central AZ’s Laura Dozer Center celebrates 20 years

UCP of Central Arizona’s Laura Dozer Center celebrates 20 years on impact UCP of Central Arizona’s Laura Dozer Center in North Phoenix is celebrating 20 years of service in the Valley this March. Located at 19th Ave. and Pinnacle Peak, the Laura Dozer facility ha